Monetary Policy, Systemic Inequality, and the Sly Round-About Way to Fix it

How Centralized Monetary Policy Produces Systemic Inequality, Examples from the Housing Market, and How to Opt Out

Abstract

Today’s monetary policy hinges on a simple pendulum-like model: if the economy is too slow, stimulate it. If it is red hot, cool it down. Easy, right? except, no one knows how to reliably measure the economy, no one knows what “red hot” or “too slow” mean, and no one know how much stimulus or tightening is sufficient. Even if the monetary authorities miraculously manage to keep this economic pendulum in the optimal state of rapid growth without inflation, we demonstrate the upside of the economic boom under stimulus and the downside under tightening go to different groups of people creating systemic and persistent inequality. Analyzing the housing market, we argue that centralized manipulation of the market has created a policy-parasite class that capture the benefits of the loose monetary policy and are immune to downsides of tight monetary policy. We then argue that the system cannot be patched from within and Bitcoin offers a “sly round-about way”, as Hayek put it, to redesign a sound and fair monetary system.

Introduction

What we know today as “monetary policy” is an unnatural outcome of governmental intervention in the monetary system in the name of fairness. In the early 20th century, with increased frequency and severity of recessions, the public had grown ever more discontent with the state of affairs demanding the governments to intervene. This afforded politicians cover to expand their involvement in the economy. The idea was to define money as a public utility and let a technocratic entity under Congress’s authority, i.e., the Federal Reserve (Fed), manage money. The Fed was tasked to ensure maximum employment and price stability. The Fed expands the money supply (e.g., by dropping the interest rates) whenever the economy falls into recession, i.e., hence loose monetary policy, to reignite the economic engine and boost employment.

This whole enterprise was (and is still being) justified as an arrangement to protect workers and regular people from the damage caused by economic downturns and to restore “fairness”. The poverty-stricken public demanded welfare and the power-hungry governments delivered. This is how the “monetary policy” as we know it was born. What followed was more than a century of politico-economic theater performed for the masses by clueless Fed bureaucrats scrambling to cover up their failure to control something as endlessly complex as the economy.

On the surface of it, the technocrats and the Ph.D. economists at the Fed are hard at work to appear to protect our interests as we go about our little lives every day. According to Keynesian economists, at any moment the economy is in danger of deflation, losing its momentum, and rising unemployment which hurts the poor the most. Thus, monetary authorities claim to be performing a protective function; protecting the economy from itself. They observe the economy from above, collect massive amounts of data and wield the main levers. With the push of a button, they speed up the economy whenever we are too lazy or afraid to work, and slow it down whenever we have too much “animal spirit”, are too productive, or have too many jobs. They are there to protect us from ourselves, curb our imprudent economic habits, and steer us in the right direction. Of course none of that is true!

What we described above is the essence of monetary policy. Understanding the billions or trillions of transactions and processes that unfold every moment in the economy is too difficult for our human brains. And, innovation, education, and true development are too hard and too micro for macroeconomists. So they invented a simple new framework:

We will aggregate away all the complexities of the economy into a handful of macro-metrics like unemployment, or inflation rate and use our tools to manipulate these aggregates. The citizenry will figure out the rest of the details… or they will not… does not matter as long as we can say we have solved the problem at the aggregate.

Today’s monetary policy hinges on a simple pendulum-like model: if the economy is too slow, stimulate it. If it is red hot, cool it down. Easy, right? except, no one knows how to reliably measure the economy, no one knows what “red hot” or “too slow” mean, and no one know how much stimulus or tightening is sufficient. It is all smoke and mirrors.

Even if the monetary authorities miraculously manage to keep this economic pendulum in the optimal state of rapid growth without inflation, in this article we will demonstrate that the upside of the economic boom under stimulus and the downside under tightening go to different groups of people creating persistent winner and loser classes. While they are experimenting with the economy and playing with models, real people get really hurt.

How Monetary Policy Distorted the Housing Market

Recall, the government’s involvement in macroeconomics is justified in the interest of equity and fairness. Economies, as they say, left to their own devices produce unfair outcomes that hurt the poor, and thus, they are here to tip the scale in favor of the little guy.

In this article, we will look at how the housing market was impacted by monetary policy. For clear reasons, politicians pay close attention to housing and have always tried to intervene, meddle, manage, and manipulate it in the name of fairness; and often making matters worse.

Before zeroing on the monetary policy, allow us to take a quick detour and touch on that “fairness” point – particularly, how affordable housing became a colossal failure and hurt the people it wanted to help. With that backdrop, we will examine how the Fed’s policy post-COVID, effectively handed subsidized housing to Wall Street and left the little guy with even less than before.

The Track Record of Government Interventions in Housing

The US government runs a variety of welfare programs. One of the hallmarks of welfare is the affordable housing program – which is basically the government subsidizing housing for certain groups of people one way or another.

While the obvious purpose of affordable housing is to alleviate poverty as we will demonstrate they have actually contributed to poverty in the long run. Several of these programs have been found to distort incentives for marriage, personal growth, and employment among the recipients.

The U.S. welfare system is largely favoring single-parent families over two-parent families and childless couples and individuals. The Social Security Act of 1935 created the Aid to Families with Dependent Children (AFDC) program intended to provide cash support only to children living without at least one of their biological parents. Thus, children for whom one parent has died are eligible, and so are children whose parents never married but are living apart or whose parents are divorced or separated. Children who are living with both parents are not eligible except when specific and more stringent requirements are met. Similarly, public housing authorities are required to give certain groups priority over others (called "preferences"). One of the preferred groups is AFDC recipients.

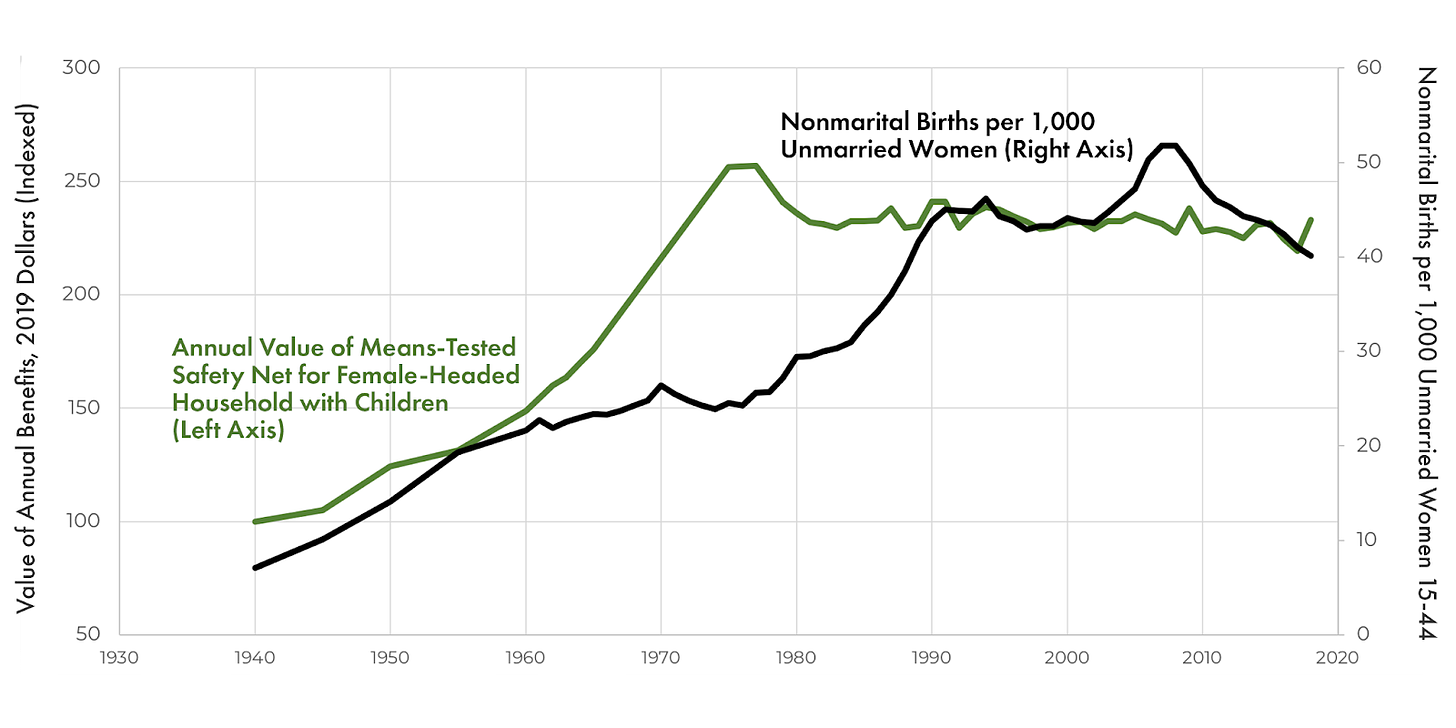

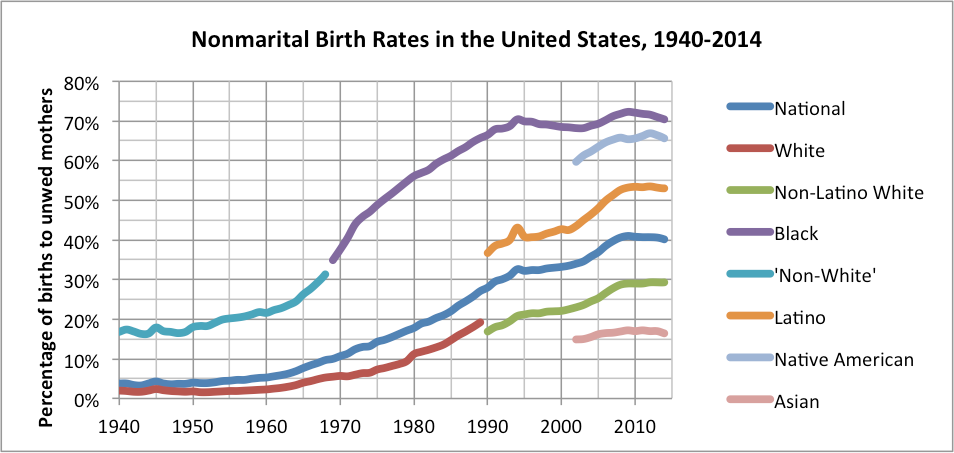

These laws incentivized single mothers to never marry in order to keep the assistance. With the expansion of the welfare system since the 1960s the marriage disincentive grew stronger and led to a rapid rise of non-marital birth. Arguably, affordable housing adversely hurt the structure of the American family. Destabilizing the family structure is one of the sure ways to guarantee long-term poverty for entire communities.

The effect was significantly worse for black families. The American economists Walter E. Williams and Thomas Sowell argue that the significant expansion of federal welfare under the Great Society programs beginning in the 1960s contributed to the destruction of African American families. Sowell has argued: "The black family, which had survived centuries of slavery and discrimination, began rapidly disintegrating in the liberal welfare state that subsidized unwed pregnancy and changed welfare from an emergency rescue to a way of life.” Arguably, any short-term benefits that were afforded to people via subsidized housing was nullified long-term. The way to keep people poor for generations is to destroy their family structure.

Is this economic travesty after expansion of welfare policies just a random correlation or the direct result of economic policy? How can we know if it was caused by government policy?

Notice, in about 1996, something changed. These apparently unstoppable trends significantly slowed down. What happened was that in 1996 Congress passed the welfare reform act, i.e., the Personal Responsibility and Work Opportunity Reconciliation Act. The main purpose of this bill was to repeal Title IV of the Social Security Act of 1935, i.e., the Aid to Families with Dependent Children (AFDC), as a categorical entitlement, and replace it by a time-limited benefit program, tied to a work requirement. Simply remaining unmarried was not profitable anymore.

According to a study by the Centre for Budget and Policy Priorities (CBPP), the share of children living with single mothers on less than twice the poverty rate fell from 34.2% in 1995 to 32.8% in 2000. This group includes most welfare recipients. The revival of the nuclear family in the past few decades has been driven by many things (from education to a new long-lasting injectable contraceptive). But it has been particularly notable amongst welfare beneficiaries. The proportion of black children living with their married parents rose from 35% in 1995 to 39% in 2000—a rise almost three times bigger than that in the whole population.

Natural underlying social trends do not switch direction that fast on their own. It is most likely that the welfare policy was the driver of the adverse trends from the 1960's onward as we can clearly identify the mechanisms of the effect: distortion of incentives.

Despite the progress since, the damage remains far from undone and the adverse effects of growing up without one parent continues to impact the adult lives of children affected.

The American Dream for Rent

The above story is just one sad example of how government economic interventions typically leave people in worse shape. Another example is how the Fed destroyed the affordability of housing for many American families by manipulation of the interest rates and purchases of mortgage-backed securities to “support the housing market” after the COVID pandemic.

The Great Gobbling

Post COVID pandemic, an unprecedented quantitative easing program was unleashed by the Federal Reserve involving massive purchases of mortgage-backed securities. This coupled with stimulus checks from the treasury, created a flood of easy money that found its way into scarce assets, including houses. The utilitarian value of a house was supplanted by its speculative value. Houses were now the de-facto store of value.

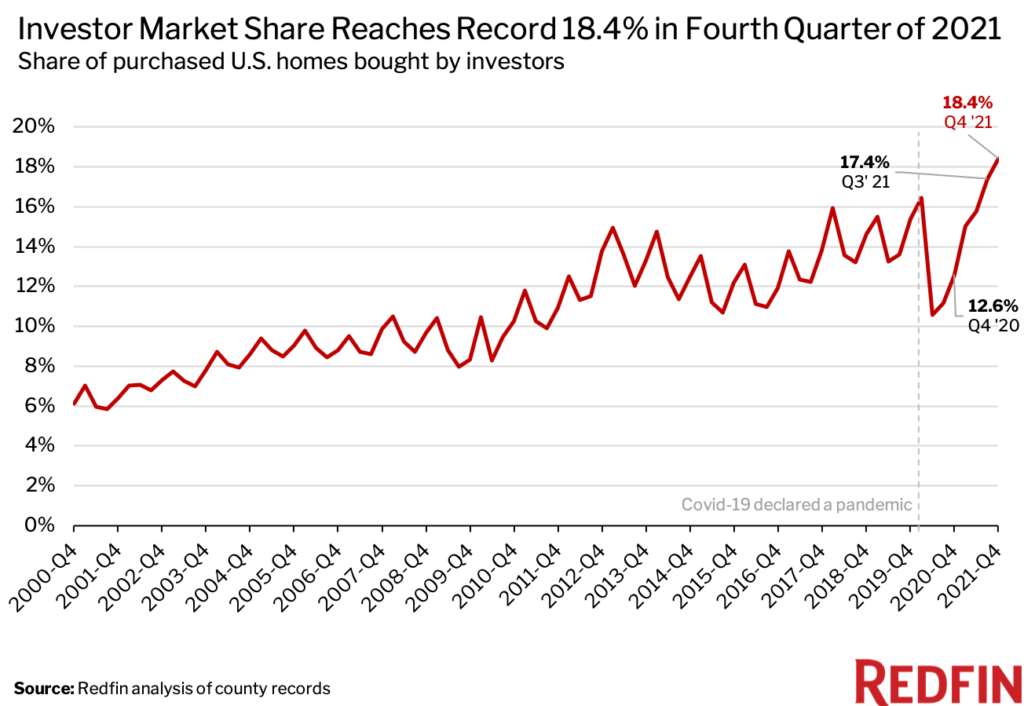

While the stated goal was to support the poor that were being crushed by the government-mandated shutdown of the economy, Wall Street was able to make the most use of this free money. A frenzy of institutional buying of residential real estate ensued. By the first quarter of 2021, corporate investors had snatched up 15% of U.S. homes for sale; Wall Street Journal reported in April 2021 that one investment firm won a bidding war to purchase an entire neighborhood worth of single-family homes in Conroe, Texas.

Institutional investors were able to acquire very low loan rates that the typical individual buyer could only dream of and lock them for up to 30 years. Invitation Homes – a real estate investment firm – is a case in point. After the Fed slashed rates to zero after COVID, normal people typically paid a mortgage interest rate of 2%-4%. However, Invitation Homes was able to borrow billion-dollar loans for far less: around 1.4%. In practice, this enables them to bid more for houses, and in cash, giving them a big leg up in a competitive market.

Importantly, this was accomplished not with their own purchasing power, but with borrowed money from the Fed. This money was allegedly intended for people to benefit from the rate reduction policy. However what really happens is major investment firms seem to always gain ground off of these monetary policies. In this instance, the asymmetric game is to buy as many houses as you can, to then acquire as much buying power in subsidized loans as you can; and every single extra dollar loan you can obtain at 1.4% is a win at the expense of the individual.

Investment Firms Aren’t Buying All the Houses. But They Are Buying the Most Important Ones. – Slate, June 19, 2021

By the end of 2021, the share of investors in the real estate market had reached a record 18.4%, up from 12.6% a year earlier, as reported by RedFin. The great gobble-up of houses was in full swing. The Fed essentially handed a countless number of subsidized houses to Wall Street at the expense of true single family home buyers.

The Inevitable

This led to what you would think would happen: an unprecedented rise in house prices. The median home that would go for $330,000 prior to the pandemic was sold at a whopping $480,000 at its top. No fundamental change in the value or desirability of houses can justify this dramatic 45% appreciation other than monetary expansion.

Then rate hikes began. The free money window was closed. And investors are dumping houses in the frothiest markets while others are keeping the subsidized low mortgages for the next 30 years.

With the housing market repurposed to the speculative backyard of Wall Street, houses are not affordable anymore for the average buyer. Instead they have to rent it from investors at monthly payments higher than their would-be mortgage rates if they had a chance to get their hands on one. MetLife Investment Management, projects institutional investors to control 40% of U.S. single-family rental homes by 2030.

Again welfare economics backfired on the same people it was supposed to help. They hurt regular folks so massively and plainly that it makes you wonder if this outcome is exactly what the system is designed to deliver.

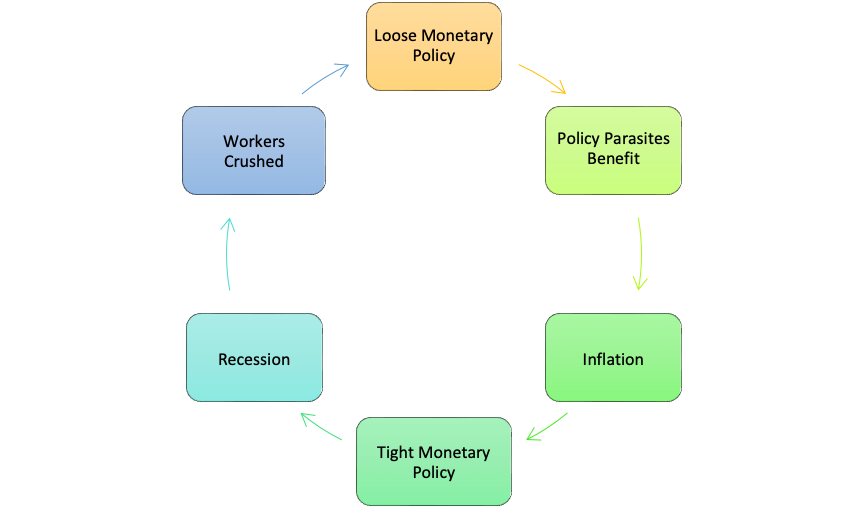

Inequality Sponsored by Monetary Policy

With the majority of mortgages in the US being 30-year fixed rate, these businesses have locked in artificially low rates for three decades. All this excess demand created by monetary policy is inflationary. However, these investors are immune to any monetary policy alteration. So when the inevitable inflation ensues, the Federal Reserve cannot hike rates on these players. The Fed will have no influence on their consumption pattern. So the rest of the economy is left to foot the bill. Rates will have to be hiked much more now until a meaningful reduction in the aggregate consumption occurs. And, much of the demand destruction will have to happen for new buyers. That is the average Joe who has to buy a house irrespective of the macro trends will face significantly higher rates and reduce their other expenses. The excessive purchases of housing investors in the post-COVID era, will be balanced by demand destruction of the average consumer. See a pattern here?

The Free Market is the Epitome of Fairness

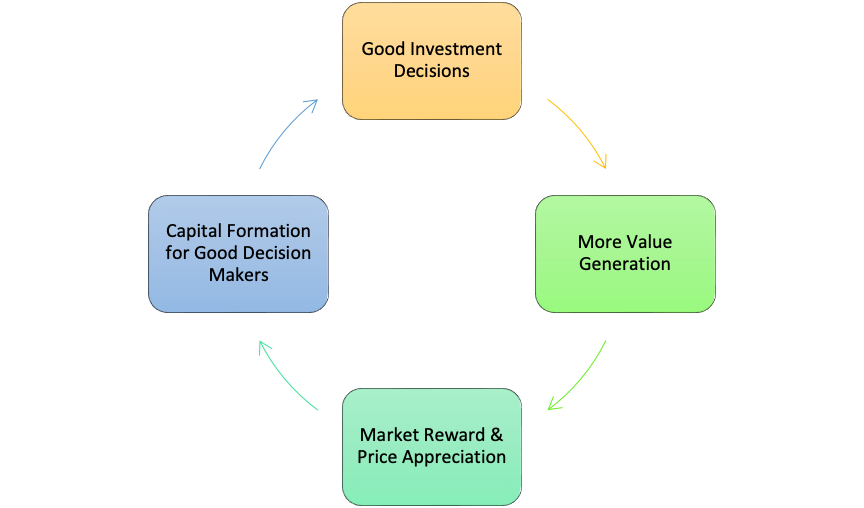

In a free market, every individual’s economic actions will have a consequence commensurate with their merits. If you invested in or built a house that ends up being very valuable for the market (e.g., correct anticipation of future demand, or a high-quality design), kudos to you. You allocated capital efficiently, and will be rewarded by appreciation of your property. The economy now awards you with more wealth to allocate again because you were a better decision maker than others. Make mis-investments in the future, and the economy will take it back. The market process is the epitome of fairness as it rewards good decisions and punishes bad ones.

How Success is Achieved in a Free Market

Centralized Monetary Policy Produces Systemic Inequality

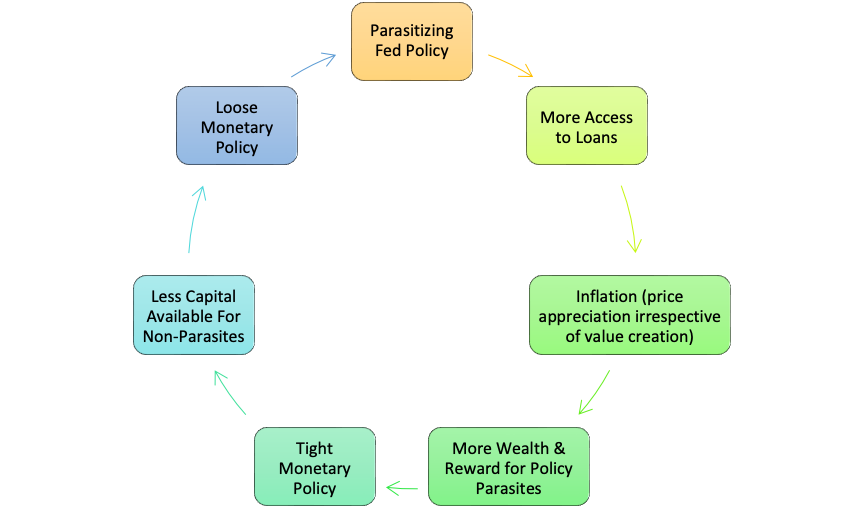

The meddling of the Fed and the subjective determination of interest rates, derails the above dynamic. The rules of the game are not fair anymore. Rewards are now given to those who anticipate the Fed’s policy and leverage it for their benefit – who we call the “Policy Parasite” class. By contrast, the working class who spend their time creating value for their fellow citizens, rather than watching the Fed, will miss opportunities. Over time, capital accumulates in the hands of policy parasites.

How Success is Achieved Under Centralized Monetary Policy

As you can see, centralized policy rewards policy parasites by more capital, and then has to take away capital from others to compensate for the inflationary pressures. Exactly for this reason, over time, compensation and reward separate from work and value. Success is not the result of production; it is rather the result of connection, proprietary information, and access to the subsidized money.

Similarly, under these dynamics, the contribution of cheap capital to corporate success overshadows the contribution of workers leading to separation of work from compensation. This trend is manifest in the fact that since 1978, the CEO pay has outpaced a typical worker’s compensation by more than 1300%. Right when our monetary overlords are lecturing us about alleviating inequality via monetary policy, they are creating it themselves.

It has now been 3 years since the US started printing $4 trillion in stimulus and lowered rates to 0% overnight. We are still dealing with 23 straight months of inflation at 5%+ and the fastest rising rates in history. Not to mention, we have added $8 trillion in US debt since 2020, by far the biggest 3-year jump in history. “Free” money from stimulus will go down as the most costly handout of all time. Inflation is the biggest involuntary tax in the world and it will come out the pockets of … whom? you guessed it right… primarily the poor who the policy aimed to support.

Simply put, this is how the true economic cycle looks like:

This is inequality sponsored by centralized monetary policy!

There Is No Patching the Current System

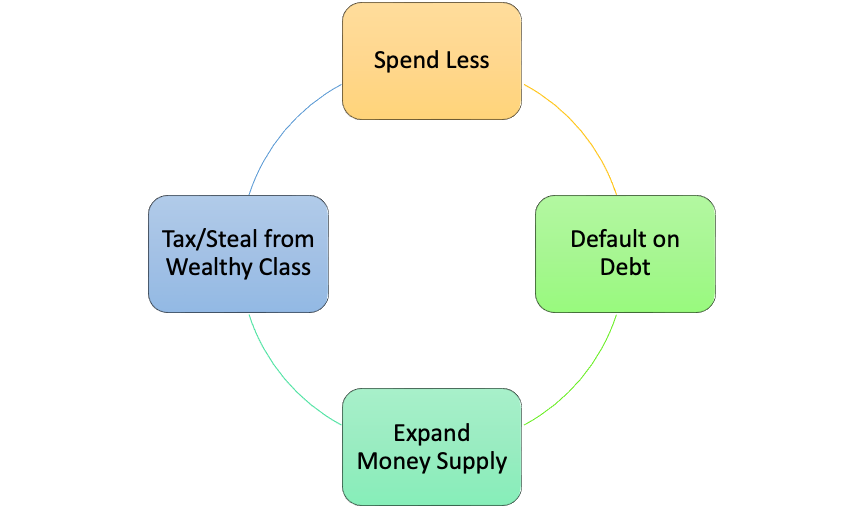

What then should we as individuals do? This issue is not as simple as voting for the right person. Time and time again, the small pool of politicians we are allowed to choose from work against our interests to steal increasingly larger chunks of our time value (savings). They will claim the taxes and inflation are for the greater good, but the outcome for the common man is virtually always net negative. Political leaders will speak about stimulating the economy, but will never think of hurting their own stake for the sake of it. Jeff Booth indicated in The Price of Tomorrow that there are four ways to reverse toxic economic conditions:

The problem is that these actions are diametrically opposed or catastrophic to a centralized monetary system. Keynesian economics is driven by and incentivizes participants into spending more. Expanding the debt ceiling, while publicly disputed, always results in a government budget expansion regardless of party. The monetary supply (M2SL, FRED) has been in a constant state of expansion for decades with exception to the last 12 months. This roughly 5% pullback of money in the economy has coincided with the collapse of 3 American financial institutions. Finally, the idea to egregiously tax the wealthy benefactors of a corrupt system will disincentivize their productivity, henceforth. Communism works only when no one values their individual time.

It is clear to say this fiat experiment is on its last leg. While no one knows when it will give out, we can have clarity in the utter disparity of the system by looking at Bitcoin as a serious alternative.

I ask again what would voting do? As desperate an issue as economics is for the average consumer, notice how austere monetary policy is not up for debate. Is there ever a vote to outlaw the expansion of the money supply? How do we need so much now when only 10 years ago we had half as many units? You are not allowed to maintain your savings or you will have more economic power than your leaders think you deserve, so they manipulate it to create a never ending cycle of suffering for the many and easy control of economic power for the few.

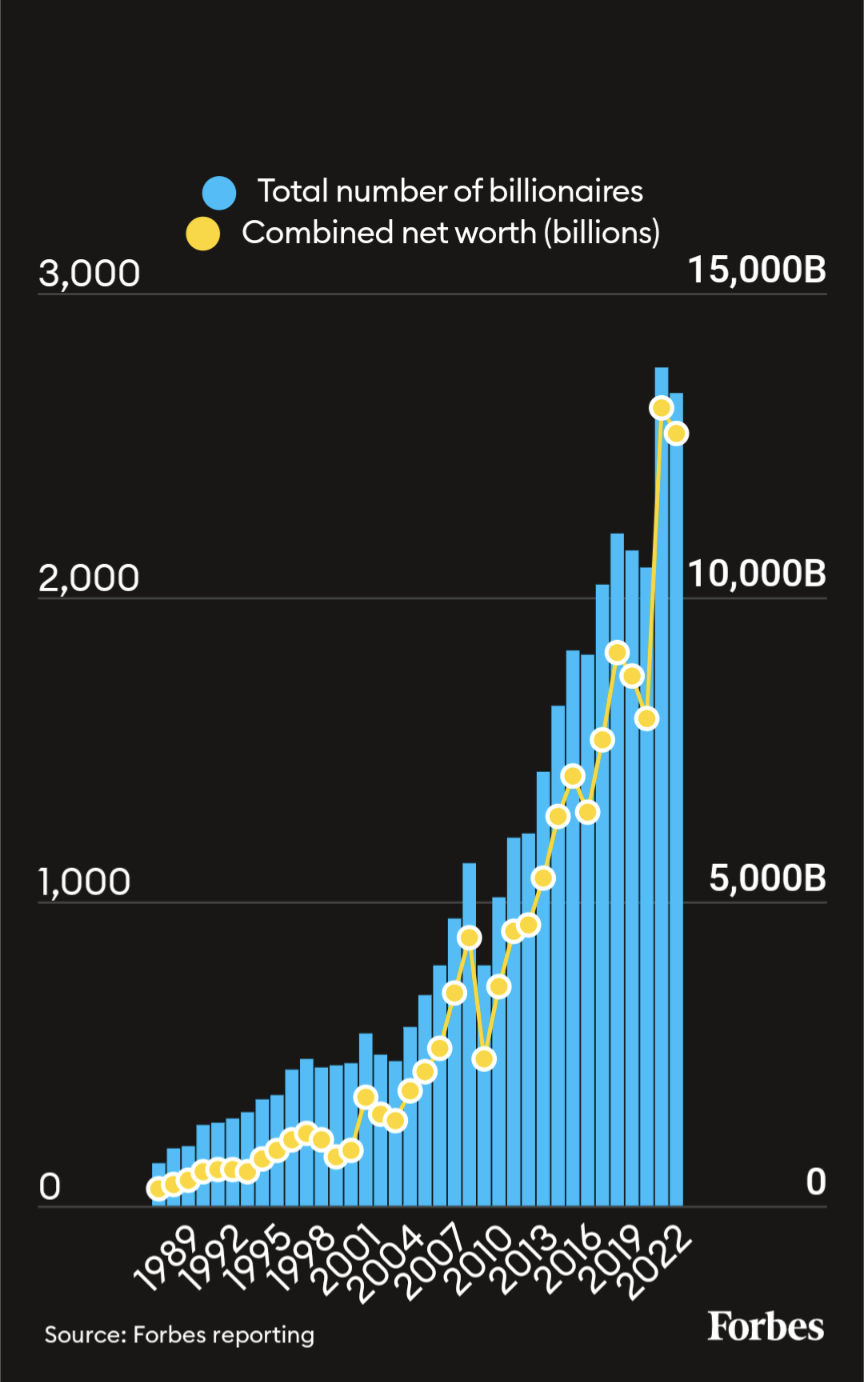

Amidst a pandemic when trade all over the world grinded to a halt, the world somehow manifested of a record number of billionaires (2755 in 2021, a record 31.5% increase YoY) and a record amount of buying power in that demographic ($13.1T in 2021, a record 63.8% increase YoY).

Was the COVID shutdown a clever scheme to further enrich the elite at the expense of a scared world populace? Even the most austere worldview cannot discount the gravity that wealthy participants have in our fiat monetary network. The Cantillon Effect is real, but Bitcoin fixes that.

Money not applied to creating more value will consolidate in the hands of the most powerful. Power is manifest by means of law creation, banking preference, and information priority. This is not to say we should think creating positive laws against the political class would fix our economic destitution. For one, politicians creating an artificial barrier against themselves would never seal themselves off entirely. A simple solution to crooked politicians is to disable money creation. Over the course of time, entities with low value creating activities will disperse their funds to those with high value creating activities. Value is determined not by a few elites (central bankers, politicians, industry leaders) with blind spots and biases, but by an entire free-market that takes into consideration input from all participants.

With Bitcoin, Financial Transparency Is Inevitable

This idea, to a rational free-market proponent, is altogether idealistic, progressive, and impossible. It is obviously better for market participants to get the government out of the market, it is also unrealistic to expect that any entity so able would not act on that ability to benefit their own existence. No government in history has died or contracted for the better of the people. It has only been via kicking and screaming that the state has relinquished power. And that power has quickly been acquired by a new state with new motives, but same incentives.

I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can't stop. - Friedrich A. Hayek, 1984

Bitcoin destroys the incentives of theft. It does this by encoding it's rules in the software operated by a network of individually owned nodes. These rules that govern the Bitcoin network are the reasons the participants have committed time, money, and hardware in the first place. Total supply capped at 21 million coins, no trusted 3rd party for transactions, hard-coded plan for new monetary units, and using energy (as opposed to violence) to secure the network, creates an impenetrable barrier to entry for bad actors. Bad actors realize this and protest the very existence of Bitcoin. You recognize those people. They are pillars of the status quo that have been enriched through the monopolization and politicization of money. (central)bankers, career politicians, DC bureaucrats, Wall Street Cantillionaires, and mainstream media executives all recognize the disruptive innovation Bitcoin presents to their way of life.

The idea of banning or destroying Bitcoin worldwide, once a legitimate risk scenario, is ironically less likely than the destruction of the dollar-system. The sheer number of nodes, the volume of hash rate securing the history of the timechain, the capitalist institutional adoption, the accelerating retail adoption, and of course the falling unit to unit market value of the dollar against a bitcoin creates a scenario where banning it is an expensive and fruitless venture. The Bitcoin Protocol, a true open source standard, is as free to operate as one’s access to the Internet itself. Even though on ramps and off ramps via centralized exchanges could be blocked in certain domains, that would only accelerate the circular, parallel economy. People would transact for goods and services in Bitcoin without regard to cashing out for archaic and innately poisonous fiat currency.

One country’s attempt to ban Bitcoin simply means they ban themselves and their constituents from the network. Could you imagine banning your people from the internet? How does that improve their life? It begs the question that every person watching Bitcoin grow from the sidelines should be asking: “Is my country hurting me or helping me by banning me from participating in an open source protocol native to the internet?” If you are free thinking enough to give the right answer to that rhetorical question, the next question should only be “how do I self-custody some of this Bitcoin for myself?” For more on the game theory behind Bitcoin’s inability to be canceled, check out this classic essay from Parker Lewis, 2019.

Shining the Light on Nefarious Actors

Preserving the ability to transact value for all participants negates the ability for political actors to sanction or censor other participants. Money in the form of currency has always been a tool for government control and has expanded in step with technological advancements over time. Bitcoin is a tool that disrupts centralized forces intent to gatekeep value exchange for profit or fear. Canada freezing bank accounts of truck drivers, NATO countries freezing assets of Russian oligarchs and imports to common citizens, and a decades-long economic embargo on Cuban people by the USA are just a few examples of nation-states willingness to partake in economic collateral damage on individual people for the sake of a political war.

Theft and coercion are the chief incentives for pursuing politics as a career. Bitcoin, as a mitigator to both of these, highlights nefarious participants in society. If someone in leadership or on your ballot does not celebrate the discovery and adoption of Bitcoin, they likely wish to steal from and control you. It is so simple to identify a bad actor; if we only had a tool like this in the past! It makes assessing politicians, religious leaders, philosophers, and other role models so much easier. Bitcoin adoption will drain every swamp faster than any political hero one could desire.

Whether purposeful or not, it seems Bitcoin is the perfect incarnation of Hayek’s “sly roundabout way”.

(Article also published on Simply Bitcoin)

Co-Authors

Sinz_Bitguide

Bitguide Co-Founder and a Professor of Business

Twitter: @Sinz_Bitguide

Website: www.Bitguide.io

Ser Ulric

Bitcoin Enthusiast and Writer – Ulric’s writing covers issues such as bitcoin and freedom, government coercion, and central banking.

Twitter: @kobiduran

Website: www.SerUlric.com